Highlights:

- Tron’s Justin Sun has amassed over $60 million in profits from selling some of his massive ETH holdings.

- The founder’s trading escapades surfaced a few days after he advised his X followers to keep accumulating cryptocurrencies like Ethereum.

- Ethereum saw slight declines in its short-term price change interval as a market expert speaks on urgent ETH procurements.

Tron (TRX) founder Justin Sun recently cashed $60 million from Ethereum (ETH) sales. Spotonchain, a renowned crypto transactions tracker, spotted the Tron founder’s trading escapades. As usual, the on-chain tracker reported the transactions on its verified X handle. According to Spotonchain, the transactions that culminated in the significant profit were from the dumping of 19,000 ETH into HTX.

Sun sold the tokens at $3,202 per token, eventually amounting to about $60.83 million in total valuation. Notedly, the deposited tokens were part of the Tron founder’s earlier 392,474 ETH accumulations. Per Spotonchain, Sun spent roughly $1.19 billion to procure the over 350K ETH between February 8 and August 5.

Meanwhile, he spent an average of $3,027 per token during the massive purchase. With the latest sell-offs, Spotonchain noted that Sun amassed about $69.36 million in profits, signifying a 5.69% surge following Ethereum’s remarkable price appreciation.

Justin Sun (@justinsuntron) appears to be cashing in on $ETH amid the latest market rally!

15 hours ago, he deposited the first 19,000 $ETH ($60.83M) to HTX at $3,202.

This was part of the net 392,474 $ETH he allegedly acquired at an average price of $3,027 (est. cost: $1.19B)… https://t.co/976PXgoJ80 pic.twitter.com/UCNpE0vnVp

— Spot On Chain (@spotonchain) November 11, 2024

Ethereum’s Remarkable Price Actions Amid the Generalized Crypto Market Rally

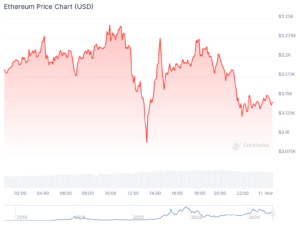

Considering the current crypto market surge frenzy, one could assert that the sales targeted potential profits. At the time of press, Ethereum is changing hands at approximately $3,130, reflecting a slight 1.3% decline in the past 24 hours.

While its short-term price change variable reflected declines, its other extended periods displayed increments, highlighting ETH’s remarkable run in recent times. Notedly, its 7-day-to-date, 14-day-to-date, and month-to-date variables reflected upswings of about 27.1%, 26.4%, and 28.3%, respectively.

With the recent price spikes, Ethereum’s market capitalization has surged to about $378.037 billion. Its 24-hour trading volume is up by 36.26%, boasting a $44.76 billion valuation.

Sun Sold-off his ETH Holdings Despite Advising Followers to Accumulate the Token

In one of its old publications, Crypto2Community reported how the Tron founder spoke on macro crypto policies and their impacts on investors’ decisions. In the report, carved out of Sun’s November 7 tweet, he expressed confidence in the crypto market expansion potential.

When the tweet on macro policies graced the online space, the market was already bullish, with Bitcoin trading around the $75,000 price region. Consequently, Sun advised investors to continue accumulating and building cryptocurrencies. The Tron founder specifically mentioned Ethereum in his tweet. Hence, his recent ETH sell-offs would undoubtedly come as a surprise to his ardent followers.

With the improvement in macro crypto policies, we are very optimistic about the market outlook(including ETH). Instead of selling, we believe it's an excellent time to continue accumulating and building.

— H.E. Justin Sun🌞(hiring) (@justinsuntron) November 7, 2024

Reacting to the sell-offs, few market participants have speculated that the Tron founder will spend proceeds from the dumpings to pump up the Tron meme. While the claims remain unconfirmed, the speculations emanated from Sun’s recent tweets.

In one of his most recent X posts, the Tron founder wrote, “Tron meme is back.” In another tweet, Sun stated, “Make Tron Great Again.” It is left to see how events unfold for the Tron ecosystem, especially as the crypto market continues to gear for a more expansive breakout.

Expert Speaks on Accumulating ETH Amid Slight Dip

In a tweet that has attracted considerable attention, evidenced by its over 30K views in roughly two hours, a market expert spoke on urgently procuring ETH. Per the expert, Ethereum has never remained in the red for more than four hours after the last U.S. presidential elections. He added that most ETH declines rarely last one to two hours. Therefore, anyone hoping to buy the dip must do so quickly.

Since the elections the longest #Ethereum dip has lasted 4 hours. Most don't last more than 1 to 2 hours. If you are trying to buy dips you have to be very quick. pic.twitter.com/MffqbeTnbO

— IncomeSharks (@IncomeSharks) November 11, 2024