Highlights:

- BlackRock attracted cash inflows worth over $1 billion to spike Bitcoin ETFs’ net inflow value.

- IBIT’s massive contribution resulted in Bitcoin ETFs attracting their highest-ever inflows of about $1.38 billion.

- Bitcoin’s remarkable market actions saw the token clinch a new peak price amid massive exchange accumulations.

BlackRock Bitcoin ETF (IBIT) generated waves across the crypto market after recording its daily highest-ever inflows. According to the latest BTC ETFs flow data, IBIT’s latest outing saw the commodity attract approximately $1.12 billion on November 7.

BREAKING: @BlackRock Bitcoin ETF sees record inflows, hitting $1.12 BILLION in a single day as #Bitcoin continues to break all-time highs! 🚀🔥

After two days of outflows totaling $113.3M, the world’s largest asset manager is back with a BANG! #BlackRock pic.twitter.com/DjRhT2Pu4g

— Breaking Whale (@BreakingWhale) November 8, 2024

“In the past three weeks, BlackRock has added a net 77,649 BTC ($5.48 billion), raising its BTC holdings to 447,281 BTC ($33.86 billion), ~2.26% of the circulating supply,” Spotonchain asserted in an attempt to highlight BlackRockk’s remarkable market movements.

🔥 The 11 US BTC ETFs just recorded a new biggest inflow of $1.372B after 167 days!

This was backed by #BlackRock (IBIT) which saw a massive inflow of $1.169B yesterday – its largest BTC inflow since launch.

In the past 3 weeks, BlackRock has added a net 77,649 $BTC ($5.48B),… pic.twitter.com/cLvGdJ9CRZ

— Spot On Chain (@spotonchain) November 8, 2024

Meanwhile, IBIT’s massive input contributed to Bitcoin ETFs spiking to a new all-time high (ATH). Notedly, the commodities raked in $1.38 billion in net inflows, marking their highest single-day profitable outing since they graced the crypto space.

Despite recording losses twice this week, Bitcoin ETFs have rebounded strongly and could be on course to conclude the week with net profits worth over $1 billion. For context, BTC ETFs’ weekly net gains are about $1.344. Hence, a $2 billion net inflow remains a valid possibility if the entities maintain current momentum in today’s market outing.

Profitable Inputs from Other Bitcoin ETFs

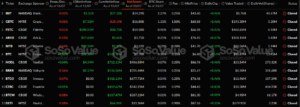

Aside from IBIT, seven other BTC ETFs were active on November 7, as three others recorded zero flows. The three entities with no activities include Invesco Bitcoin ETF (BTCO), Franklin Bitcoin ETF (EZBC), and WisdomTree Bitcoin ETF (BTCW).

Profitable values from every other commodity were meager relative to BlackRock’s. Notedly, only Fidelity Bitcoin ETF (FBTC) witnessed over $100 million in gains by attracting inflows valued at roughly $190.92 million. Meanwhile, three other ETFs saw over $10 million in profits.

They include Grayscale Mini Bitcoin ETF (BTC) ($20.4 million), ARK 21Shares Bitcoin ETF (ARKB) ($17.6 million), and Bitwise Bitcoin ETF (BITB), with $13.4 million. The three remaining commodities witnessed less than $10 million in gains.

These entities are Grayscale Bitcoin ETF (GBTC), VanEck Bitcoin ETF (HODL), and Valkyrie Bitcoin ETF (BRRR). They attracted profits of about $7.3 million, $4.3 million, and $2.2 million, respectively.

BTC ETFs Cumulative Net Inflows Exceed $25 Billion as IBIT’s Nears $30 Billion

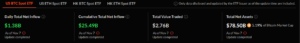

With the most recent gainful inputs, Bitcoin ETFs’ cumulative net inflows spiked considerably. The variable is now worth approximately $25.49 billion. Moreover, the total value traded was about $2.76 billion, while total net assets surged to about $78.5 billion. The total net assets valuation represents 5.19% of Bitcoin’s market capitalization.

Similarly, BlackRock’s cumulative net Inflow experienced a tremendous boost. The metric displayed a $27.18 billion valuation. The commodity’s total value traded was $1.76 billion, while the total net assets reflected approximately $34.29 billion.

Bitcoin’s Price Attains New ATH with Impressive Price Actions

At the time of writing, Bitcoin is changing hands at roughly $76,000, reflecting a 1.5% upswing in the past 24 hours. The flagship cryptocurrency’s remarkable run post-Trump election victory continues, with the token establishing a new peak price of $76,872.61 on November 7, 2024.

Should BTC sustain its remarkable run, chances abound that it might exceed $80,000 soon. Meanwhile, while ETFs attracted investors’ funds, Ali Martinez, a renowned chartist, recently disclosed that traders are accumulating BTC from exchanges.

According to the crypto market expert, trades have withdrawn over 24,000 BTC from trading platforms. Martinez noted that the procured tokens cost approximately $1.8 billion.

Over 24,000 #Bitcoin $BTC were withdrawn from crypto exchanges in the last 72 hours, worth $1.80 billion! pic.twitter.com/qWadovjzY7

— Ali (@ali_charts) November 8, 2024