Highlights:

- Bitcoin hit a new all-time high of over $75,000 as Trump’s election odds rose.

- Bitcoin’s surge lifted the crypto market, with Ether, Dogecoin, and Shiba Inu rising.

- Trump’s pro-crypto stance and potential SEC shift could drive further market growth.

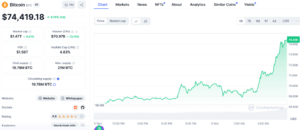

Bitcoin (BTC) surged to a new all-time high (ATH) of over $75,000 on crypto exchanges Coinbase, Binance, and others in Asian morning hours on November 6, as favorable election results for crypto-friendly Republican Donald Trump began to roll in. The leading cryptocurrency surged past its previous peak of $73,750 set in March, showing a strong positive response from the market. At the time of publication, Bitcoin is trading at $74,419, up 9.15% over the last 24 hours.

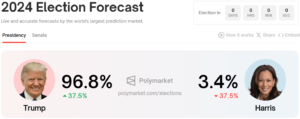

This increase aligns with Trump’s improving odds on Polymarket, where bettors now give him a 96% chance of winning the U.S. presidency. Traders generally see a Trump win as positive for the crypto industry, contrasting with Kamala Harris, who is not widely seen as crypto-friendly.

Bitcoin’s new all-time high has lifted the entire cryptocurrency market, driving significant gains in various digital assets. Ether, the second-largest cryptocurrency, was trading at $2,570, up over 6% in 24 hours. Memecoins also surged, with Dogecoin rising over 24% and Shiba Inu up 10%.

Markets Anticipate SEC Shift Under Trump

The former president has called himself a “crypto candidate” and supports digital assets. He even started accepting campaign donations in Bitcoin, Ether, Dogecoin, Solana, and more. Many crypto enthusiasts have praised Trump’s recent pro-crypto stance.

At a Bitcoin conference, he vowed to fire SEC Chair Gary Gensler on his first day in office. This move resonates with crypto advocates, as Gensler’s policies have often been unpopular in the community. Trump also promised to create a national Bitcoin reserve, an ambitious goal that has captivated many crypto supporters.

Trump said at the Bitcoin Conference that if elected in November, he would fire Gary Gensler, prevent the U.S. from selling its Bitcoin holdings, and build a strategic Bitcoin reserve. Trump also praised the development of stablecoins and support for the Bitcoin mining industry…

— Wu Blockchain (@WuBlockchain) July 27, 2024

Trump Leads in Early Election Results

Early election results from the Associated Press showed Trump leading with 198 electoral votes, while Kamala Harris had 112 as of 3:30 am UTC on Nov. 6. Each candidate requires a minimum of 270 electoral votes to secure the win.

Although the race was still too close to call, financial markets began reacting in the Asia session, pricing in a potential victory for the former president. Matthew Dibb, CIO of cryptocurrency asset manager Astronaut Capital, said markets anticipate a shift in the U.S. Securities and Exchange Commission’s stance to remove a barrier to crypto innovation and speculation.

Historical Election Trends Show Positive Impact on Bitcoin

In the 2012, 2016, and 2020 elections, Bitcoin posted returns of around 87%, 44%, and 145%, respectively, in the 90 days after election day. This is partly due to election years coinciding with Bitcoin halving years, when the cryptocurrency’s supply decreases. Post-election returns have also aligned with major Federal Reserve policy changes. The market expects additional interest rate cuts later this year.

Head of research at Bitwise Asset Management, Ryan Rasmussen, said:

“If Trump wins, I believe we’ll see new all-time highs. If Harris wins, I expect a decent short-term sell-off, with prices taking a month or two to recover. But eventually, either way, I think we go higher.”