Highlights:

- Spotonchain has spotted massive altcoins accumulations from Gemini to a multisig wallet.

- The procured tokens include Ethereum, Chainlink, Shiba Inu, and PEPE.

- ETH and LINK dropped below crucial levels as expert predicts that altcoins’ rally will not happen this year.

In a new tweet, Spotonchain, a renowned on-chain crypto transactions tracker, spotted massive altcoins accumulation from Gemini, a United States-based crypto exchange owned by the Winklevoss brothers. The token destination was Gemini’s new multisig wallet.

“This new wallet was created just 18 days ago, with its latest activity occurring 3 hours ago,” the on-chain tracker stated. Meanwhile, according to Spotonchain, the multisignature wallet, accumulated four cryptocurrencies in considerable amounts to build a portfolio worth over $100 million. The cryptocurrencies in the wallet include two decentralized crypto projects and two meme coins.

The decentralized crypto assets were 42K Ethereum (ETH) valued at approximately $103.876 million and 350K Chainlink (LINK), with a $3.77 million valuation. On the other hand, the meme coins included 200 billion Shiba Inu (SHIB) worth about $3.392 million and 400 billion PEPE valued at roughly $3.296 million. The total coin holdings amounted to about $114.341 million.

A new Gemini multisig custody wallet has just accumulated millions in altcoins.

A Gemini multisig custody wallet, 0xc96, recently withdrew:

– 42K $ETH ($103.8M)

– 350K $LINK ($3.77M)

– 200B $SHIB ($3.39M)

– 400B $PEPE ($3.29M)This wallet was created just 18 days ago, with its… pic.twitter.com/HFtm8DONI5

— Spot On Chain (@spotonchain) November 4, 2024

Multisig Wallet Handler Investment Decision Drivers

Spotonchain tried to assess possible reasons influencing the wallet handler’s crypto procurement choices. Per the on-chain tracker, the investor’s decision potentially stemmed from altcoins’ recent underperformance.

“While BTC is approaching its all-time high, showing strong bullish momentum, most altcoins are struggling at low levels. For instance, despite BTC’s surge, LINK has reverted to its price from a year ago,” Spotonchain wrote in an attempt to decipher the multisig wallet handler’s intention.

Corroborating Spotonchain’s assertion above, ITC Crypto founder Benjamin Cowen stated that altcoins might likely suffer more declines before any potential upswing. Cowen’s bold prediction appeared in one of Crypto2Community’s recent articles. In the article, he noted that price declines will hit zenith levels by December 2024, possibly extending to January 2025.

In his projection, Cowen compared the prevailing situation with what transpired around late 2019. Per the market expert, he anticipates altcoins’ gradual recovery to happen around early 2025. Relating his assertion to the previous bull run, the expert noted that after the declines in 2019, altcoins started recovering in 2020. Eventually, they struck peak levels in 2021, where most coins established all-time high (ATH) prices.

Ethereum and Chainlink Drop Below Crucial Supports, Making their Procurements Ideal

At the time of writing, Ethereum is changing hands at about $2,400, reflecting a 1.1% drop in the past 24 hours. In the past few days, Ethereum was trading above $2,500 and was on the verge of reclaiming $3,000 at some point. However, the token couldn’t sustain the momentum, culminating in its present price predicament.

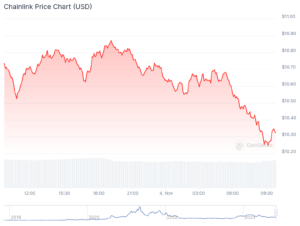

Like Ethereum, Chainlink gave enthusiasts slight hope of anticipating positive outcomes when it traded between $12 and $13. However, the hope was short-lived, with the token declining considerably. LINK boasts about $10.25 in selling price after dropping 4.3% in the past 24 hours.

Summing up its grossly embattled state, LINK’s price change variables, especially the extended intervals, displayed declines. For context, its month-to-date and year-to-date variables reflected downtrends of about 9.7% and 9.3%, respectively.

Meanwhile, SHIB and PEPE are currently facing declines. However, the meme market condition seemed reasonably palatable relative to ETH’s and LINK’s market outlook. In addition, their highly volatile nature implies that the investor can amass profits off the token at any point.

Memecoin season 📈 pic.twitter.com/6GEu3Za3Lc

— dubzy (@dubzyxbt) November 4, 2024