Highlights:

- The Dogecoin price has fallen almost 1% to trade at $0.1507 as trading volume spikes.

- About 82% of holders are in profit, and only 16% are in loss, according to IntoTheBlock.

- With the $0.1308 support intact, the bulls could build momentum. A close above $0.15 will see the bulls target $0.18.

The Dogecoin price has been in turbulence for the past few days as the crypto market has been facing intense challenges. These challenges include geopolitical tensions, speculative activities surrounding the American elections, and economic uncertainties weighing on the value of many digital assets. Dogecoin is not an exception, as it has plummeted nearly 1% in the past 24 hours, during the European trading sessions.

Despite the fall, its 24-hour trading volume has skyrocketed by 30% to $2.04 billion, indicating a growing interest in the token. DOGE is now up 5% in a week, 38% in a month and 119% in a year.

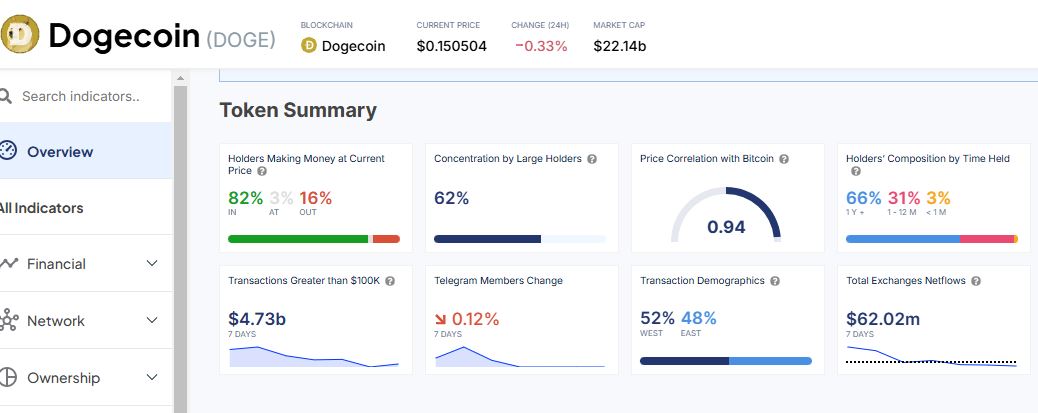

Meanwhile, the majority of DOGE investors remain in the green despite the crypto market turbulence. According to the analytics company IntoThe Block, 82% of DOGE crypto holders are profitable, a surprising figure considering the volatility of the leading meme coin by market cap. Meanwhile, only 16% are at a loss, as only 3% are at the break-even point.

This can be elaborated by the early entry of many holders who bought at levels well below the current price. Even after declines, their investment remains advantageous, proving the strength of Dogecoin in a complex environment.

Dogecoin Statistical Data

Based on CoinmarketCap data:

- DOGE price now – $0.1507

- Trading volume (24h) – $2.04 billion

- Market cap – $22.11 billion

- Total supply – 146.65 billion

- Circulating supply – 146.65 billion

- DOGE ranking – #8

Dogecoin Technical Indicators Throw Mixed Reactions

The Dogecoin price is trading within the confines of a descending parallel channel as the meme coin price dwindles. After facing rejection at the $0.1788 mark on October 29, the bears took the reigns, as they breached the $0.1583 support level, coinciding with the 50-day SMA.

However, diving into the technical information, Dogecoin seems to be moving in a short-term bearish phase, which is a challenge for bulls. Nevertheless, DOGE still has support above the 200-day SMA at $0.1308.

On the other hand, the Relative Strength Index has plunged below the 50-mean level, currently at 42.19. This suggests that the selling pressure is intense in the Dogecoin market, tilting the odds in favor of the sellers.

Worsening the outlook is the Moving Average Convergence Divergence (MACD), which has dived into negative territory. Moreover, the blue MACD line has flipped below the orange signal line, upholding a bearish outlook. Traders and investors, in the meantime, are inclined to sell unless the MACD changes.

Dogecoin Price Prediction: Will the Bulls Rebound?

From a technical view, Dogecoin appears to be moving within a short-term bearish phase, which poses a challenge for the bulls. However, if the $0.1308 support level holds, a close above the $0.1583 mark will be a catalyst for a significant rebound with the target of $0.18.

On the downside, if the bears keep dominating and selling pressure increases, the price will drop further. In such a case, the $0.1308 will act as a cushion against downward pressure.