Highlights:

- Bitcoin ETFs recorded over $400 million in net inflows, concluding the week with profits worth over $900 million.

- BlackRock’s domineering buying spree continues with a $291.96 million cash inflow attraction in the October 25 flow data.

- Ethereum ETFs registered net outflows from only ETHE to end the week in losses.

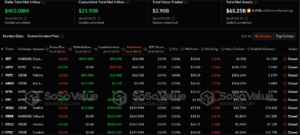

On October 25, Bitcoin (BTC) Exchange Traded Funds (ETFs) recorded their last trading day of the week with impressive cash inflows. Per SosoValue statistics, the commodities welcomed roughly $402.08 million. The latest inflow saw Bitcoin ETFs conclude the week with $997.7 million in net weekly profits. In addition, it implies that the Bitcoin commodities were profitable in four outings with only one day of recording losses.

As usual, BTC ETFs most valuable asset manager, BlackRock (IBIT), was instrumental in Bitcoin’s remarkable run. The entity attracted approximately $291.96 million in cash inflows to accumulate over 4,300 Bitcoin. With the new purchase, BlackRock BTC holdings exceeded 400,000. Noteworthily, its cumulative net inflows soared to about $23.99 billion with roughly $26.98 billion in net assets.

🚨Blackrock Buys 4,357 #Bitcoin ($291m) and now holds over 400,000 #Bitcoin

Larry keeps pumping his #Bitcoin bags pic.twitter.com/KivDLhqCWf

— Simply Bitcoin (@SimplyBitcoinTV) October 26, 2024

Meanwhile, Spotonchain, a renowned on-chain tracker, highlighted IBIT’s contribution. According to the on-chain tracker, IBIT has remained persistent in BTC procurements. It added that the asset manager purchased 17,111 BTC worth approximately $1.14 billion in the just-concluded week.

🇺🇸 Spot ETF: 🟢$995M to $BTC and 🔴$24.7M to $ETH

🗓️ Week: 21 to 25 October 2024👉 The weekly total flows for both BTC and ETH ETFs saw significant drops compared to previous trading weeks.

👉 However, #BlackRock (IBIT) remained a strong buyer, adding 17,111 $BTC ($1.14B) this… pic.twitter.com/MBLO4bpnHV

— Spot On Chain (@spotonchain) October 26, 2024

Cash Inflows Input from Other Bitcoin ETFs

While IBIT might have stolen the spotlight from Bitcoin ETF flow data, several other entities contributed to the impressive trend. Notedly, three entities witnessed over $10 million in gains. They include Fidelity Bitcoin ETF (FBTC) with $56.95 million, ARK 21Shares Bitcoin ETF (ARKB) with $33.37 million, and VanEck Bitcoin ETF (HODL) with $11.34 million.

Aside from five ETFs that registered zero flows, two other commodities witnessed less than $10 million in net inflows. They include Grayscale Mini Bitcoin ETF (BTC) and Bitwise Bitcoin ETF (BITB). Both entities welcomed gains of about $5.92 million and $2.55 million, respectively.

Following the recent flow trend, Bitcoin ETFs’ cumulative net inflows soared to about $21.93 billion. The total value traded spiked to roughly $2.9 billion, while total net assets reflected $65.25 billion. The $65.25 billion represents 4.93% of Bitcoin’s $1.325 trillion market capitalization.

Ethereum ETFs Accumulate Losses to Conclude the Week in Net Outflows

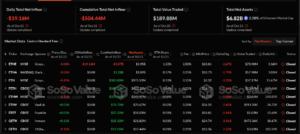

Unlike Bitcoin, Ethereum ETFs poor run continued on October 25. According to SosoValue’s data, the commodities welcomed roughly $19.16 million in net outflows. All ETH ETFs recorded zero flows apart from Grayscale Ethereum ETF (ETHE), which witnessed the only losses accounting for the negative flow outcome.

With the recent flow data, Ethereum’s cumulative total net inflow plunged into further losses worth $504.44 million. Meanwhile, the total value traded was $189.88 million, while total net assets reflected $6.82 billion. The total net assets valuation represents 2.28% of Ethereum’s $297.24 billion market capitalization.

ETH’s Price Drops Below $2,500 as BTC Remains Stable Around the $67,000 Region

At the time of press, Ethereum is changing hands at about $2,460, reflecting a 1.8% decline in the past 24 hours. Within the same timeframe, ETH saw price extremes ranging between $2,398.74 and $2,555.62. The minimum and maximum price levels underscore ETH woes amid its poor ETF showings.

Contrary to Ethereum, Bitcoin witnessed a slight 0.8% decline in the past 24 hours with an approximate $67,000 selling price. Its 24-hour-to-date minimum and maximum prices reflected levels, ranging between $65,563.64 and $68,654.55. Despite the subtle drop in momentum, BTC’s 24-hour trading volume displayed a 31.81% upswing with a $40.74 billion valuation.