Highlights:

- Bitcoin’s market cap is about $1 trillion higher than Ethereum’s, reaching $1.35 trillion.

- Fred Krueger predicts Bitcoin could hit $5 million if the market reaches $100 trillion.

- Analysts warn of a potential Bitcoin price correction despite optimistic forecasts for new all-time highs.

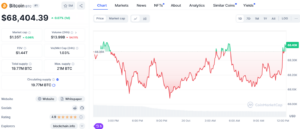

On-chain data analysis firm Glassnode’s analyst James Check noted on platform X that Bitcoin’s (BTC) market capitalization currently surpasses Ethereum (ETH) by around $1 trillion. Bitcoin’s market capitalization has hit $1.35 trillion, while Ethereum’s stands at $318 billion. This follows Bitcoin reaching $67,000 for the first time since July 28, according to CoinMarketCap. At the time of writing, Bitcoin was trading at $68,404.

Check said, “Bitcoin now has a $1 Trillion market cap lead over Ethereum, a new ATH for the spread.” He also challenged an X user who said Ethereum’s “comeback will be glorious,” replying, “It may not.”

#Bitcoin now has a $1 Trillion market cap lead over Ethereum, a new ATH for the spread. pic.twitter.com/PmcKvtQbfQ

— _Checkmate 🟠🔑⚡☢️🛢️ (@_Checkmatey_) October 19, 2024

On May 21, Bitcoin reached an all-time high market cap of $1.41 trillion. It now ranks tenth among global assets, just behind Meta Platforms (Facebook) at $1.48 trillion. According to data, gold is the largest asset by market cap, valued at $18.38 trillion.

Bitcoin Maximalist Predicts Bitcoin Could Reach $5 Million by 2040

Bitcoin maximalist Fred Krueger mentioned that the current market is valued at $50 trillion. He estimated it could reach $100 trillion by 2040, implying this would be 76 times Bitcoin’s market cap of $1.3 trillion. He suggested that, as a result, Bitcoin could potentially rise to $5 million.

"Bitcoin will become as big as the US housing market"

— Larry Fink.That market is currently 50 Trillion. Let's estimate 100 Trillion by 2040. That is 76x Bitcoin's 1.3 Trillion market cap.

In other words, Bitcoin is going to 5 Million. Source: the most important person in…

— Fred Krueger (@dotkrueger) October 14, 2024

Analysts Warn of Price Correction While Experts Remain Optimistic About Bitcoin

Crypto analyst Justin Bennett suggested in an X post that Bitcoin’s price might retrace to $63,000 after the recent market rally. He indicated that BTC could eliminate this week’s leveraged buyers by retesting the month’s open near $63,000. Bennett said a potential rising wedge pattern and bearish divergence, suggesting BTC could drop to about $63,276.

The analyst also observed that this week’s Bitcoin price rally was mainly driven by the perpetual market, which he described as not “conducive” for a sustainable breakout, particularly with open interest (OI) near its late July highs.

#Bitcoin did not break out on Friday.

Again, last week was primarily a perp-driven rally, which is not conducive to a sustainable breakout, and OI remains near its late July highs.

We now have a potential rising wedge developing with bearish divergence everywhere.

I wouldn't… https://t.co/xT8EmjpJyS pic.twitter.com/20dBgyDWL8

— Justin Bennett (@JustinBennettFX) October 19, 2024

Crypto analyst CrediBULL Crypto also cautioned about the rise in open interest, indicating that a price correction is likely. He noted that OI has now exceeded the levels seen before the last BTC price drop from $70,000 to $49,000.

Like Bennett, CrediBULL Crypto also warned earlier this week about an imminent price correction. He claimed that the derivatives market is driving the recent rally. The analyst suggested that Bitcoin could still crash to $50,000 before surpassing its current all-time high of $73,000.

Open interest has officially surpassed the level it was at before the last drop from 70k to 49k.$BTC pic.twitter.com/BklNneNf3O

— CrediBULL Crypto (@CredibleCrypto) October 18, 2024

Despite the bearish predictions, market experts remain optimistic about BTC. Bitwise CIO Matt Hougan predicted that Bitcoin could reach six figures sooner than expected. This surge is driven by increasing institutional flows into exchange-traded funds (ETFs) and economic instability.

The U.S. presidential election is also influencing this momentum. The chief investment officer of Bitwise points out that growing GOP support for cryptocurrencies is a key factor. Inflation concerns are pushing investors toward Bitcoin. He believes regulatory clarity and supply constraints from the Bitcoin halving will lead to a rapid price surge.

We're heading to six-figure bitcoin.

* ETF flows reaccelerating

* Election approaching

* Infinite deficits (bipartisan agreement!)

* Economic stimulus in China

* Global rate cuts (Fed, ECB)

* Halving supply shock starting to bite

* Whales accumulating— Matt Hougan (@Matt_Hougan) October 18, 2024