Highlights:

- BTC ETFs recorded another massive inflows worth over $400 million.

- ETH ETFs also welcomed profits valued above $20 million.

- Despite the inflows, Bitcoin and Ethereum prices have remained relatively stable.

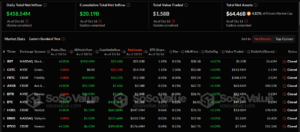

Bitcoin (BTC) Exchange Traded Funds (ETFs) recorded another net inflow, marking the commodities’ fourth consecutive day of witnessing over $200 million in gains. In the most recent flow statistics, Sosovalue revealed that the Bitcoin commodities welcomed about $458.54 million in profits.

With the October 16 flow contribution, Bitcoin ETFs have exceeded $20 billion in cumulative inflows. The metric now stands at about $20.19 billion from Bitcoin’s eleven ETFs after 193 trading days. Meanwhile, excluding the $20.14 billion outflow impact from Grayscale Bitcoin ETF (GBTC), the total inflows would have been over $40 billion.

Other findings revealed the three outings this week resulted in profits, with no entity contributing losses. Consequently, the weekly net inflows have topped $1 billion and could hit $2 billion on Friday if the commodities sustain current momentum. For context, the net profit after the first three days of this week is $1.39 billion. Hence, it supports the assertion, projecting a $2 billion weekly close.

🚀 The cumulative net inflows for 11 Bitcoin ETFs have finally reached $20 billion after 193 trading days!

Excluding #Grayscale (GBTC), the total jumps to $40B. In just the first 3 days of this trading week, the 11 BTC ETFs have brought in $1.39B, with no outflows.

In… pic.twitter.com/ZatelEbAGc

— Spot On Chain (@spotonchain) October 17, 2024

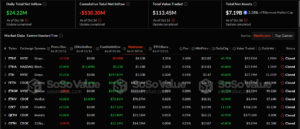

Like Bitcoin, Ethereum (ETH) ETFs also attracted cash inflows. However, as usual, the value recorded was seemingly meager relative to Bitcoin’s. Per SosoValue ETF statistics, the ETH entities witnessed approximately $24.22 million in gains on October 16. Interestingly, the recorded value stands out as ETH ETF’s highest inflow since September 27, when it attracted $58.65 million in profits. Therefore, it underscores poor outings in recent weeks.

On October 16, Bitcoin spot ETF had a total net inflow of $459 million yesterday, continuing its net inflow for 4 consecutive days. BlackRock ETF IBIT had an inflow of $393 million. Ethereum spot ETF had a total net inflow of $24.2192 million. https://t.co/59u0BnEqLG

— Wu Blockchain (@WuBlockchain) October 17, 2024

IBIT Maintains BTC ETFs Dominance with Another Over $200M Profits Contribution

After contributing $288.84 million in profits to the October 15 inflows, BlackRock Bitcoin ETF (IBIT) has stepped up with another $393.4 million profitable showing for October 16. Notedly, IBIT’s recent exploit implies that the entity was the highest contributor for the week, with about $762 million from 11,331 BTC. Overall, IBIT now boasts 380,971 BTC valued at about $25.7 billion, representing one-third of all US spot Bitcoin ETF holdings.

Aside from IBIT, no other ETF welcomed gains above $100 million. However, four commodities registered inflows above $10 million. They include Fidelity Bitcoin ETF (FBTC), Bitwise Bitcoin ETF (BITB), Franklin Bitcoin ETF (EZBC), and ARK 21Shares Bitcoin ETF (ARKB). The entities registered gains of about $14.81 million, $12.93 million, $11.79 million, and $11.51 million, respectively.

Other ETFs with inflows less than $10 million include Invesco Bitcoin ETF (BTCO), with $6.43 million, VanEck Bitcoin ETF (HODL), with $5.75 million, and Valkyrie Bitcoin ETF (BRRR), with $1.92 million. Meanwhile, Grayscale Mini Bitcoin ETF (BTC), WisdomTree Bitcoin ETF (BTCW), and GBTC all had zero flows as no entity recorded losses.

Ethereum ETFs Welcome Inflows from Three Commodities

Like Bitcoin, BlackRock topped the ETH ETFs chart as only three entities registered activities. Interestingly, all three entities saw only inflows, as six ETFs recorded zero flows. Notedly, BlackRock Ethereum ETF (ETHA) welcomed roughly $11.89 million in gains. Others include Fidelity Ethereum ETF (FETH) with $8.50 million and VanEck Ethereum ETF (ETHV) with $3.83 million.

With the latest inflow, ETH ETF cumulative net inflow losses dropped slightly to about $530.3 million. Similarly, the total value traded reduced to about $113.45 million. However, the total net assets increased to about $7.19 billion.

Bitcoin and Ethereum Record Stabilized Prices Amid Inflows

Despite the massive inflows, Bitcoin and Ethereum prices saw only subtle changes in their 24-hour price change variables. Notedly, BTC is changing hands at about $67,200 with a 0.1 percent spike in the past 24 hours. Similarly, ETH has a $2,610 selling price, with about 0.2% spike in the past 24 hours.