Highlights:

- Despite the poor market outlook, Ethereum network activity has reached a 4-month high.

- The activity surge implies faith in ETH’s price appreciation potential.

- Ethereum market sentiment remained largely bearish, implying that the network activity spike had little or no impact.

According to the renowned market intelligence platform, Santiment Ethereum (ETH) network activity has soared to a four-month high. Notably, the disclosure appeared on one of the data analytical outlet’s latest tweets, dated September 8, 2024. In its X post, Santiment noted that the recent surge surprisingly happened on a Sunday, which ordinarily is the least active day of the week.

Additionally, the market intelligence platform revealed 126,210 newly created wallets, signifying that the Ethereum network is buzzing despite its unimpressive market actions. Aside from merely implying a network spike, Santiment mentioned that the latest trend could have possible price implications.

Santiment tweet read in part:

“126,210 new wallets created is indicative of rising network utility and anticipated price bounces from the $2,200-$2,300 level.”

📈 Ethereum has just hit a 4-month high in network growth, on a day (Sunday) that is traditionally the least active of the week. 126,210 new wallets created is indicative of rising network utility and anticipated price bounces from the $2,200-$2,300 level. pic.twitter.com/zQaKbBdznK

— Santiment (@santimentfeed) September 9, 2024

Network Activity Spikes Amid Market Declines – Possible Implications?

Ordinarily, when crypto assets appear to enter a declining phase, increasing network activities have never emerged as a possible finding. If there should be a surge in network operations, it will likely be more selling actions.

However, when the activity spikes involve new wallet creation, chances of an imminent price reversal abound for the asset involved. Hence, ETH enthusiasts should anticipate a positive price momentum swing if the token mirrors conventional trends.

Ethereum Market Actions Display Unimpressive Trends

Like the general market, Ethereum’s price movements have remained disappointing, with the potential of eliciting massive sell-offs among holders. At the time of writing, ETH is changing hands at about $2,300, reflecting a subtle 0.5% upswing in the past 24 hours.

While it might have slightly increased in its 1-day-to-date price variable, other specific periods displayed losses, underscoring a debilitating state. For context, Ethereum’s 7-day-to-date, 14-day-to-date, and month-to-date variables reflected losses of about 5.6%, 15.8%, and 12.1%, respectively.

Other relevant statistics revealed that Ethereum boasts about $277.6 billion in market capitalization. Meanwhile, its 24-hour trading volume variable reflected a 23.57% upswing with a $12.04 billion valuation.

Market Sentiment Maintains Bearishness Amid Network Activity Surge

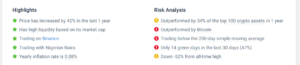

On Coincodex, other variables displayed a poor prognosis for the embattled crypto. Notedly, despite its position as the second most valuable cryptocurrency, it has only succeeded in outperforming 46% of the top-ranking digital assets. In addition, ETH is trading below its 200-day Simple Moving Average (SMA), which invariably implies an overstretched downtrend.

Following its unimpressive market actions, Ethereum’s volatility was medium at 4.99%, while supply inflation was low at 0.88%. Expectedly, the “Fear & Greed index” – the variable that mirrors traders’ attitude toward an asset displayed fear at 26. Overall, sentiment remained bearish despite the remarkable Ethereum network activity.

Ethereum Targets Support at $2,350

Ethereum’s price movement on TradingView displayed a slight upward trend after periods of consistent declines. If ETH sustains its current momentum, it could head toward potent support at $2,356.2. Subsequently, $2,410 will become the next target. Hence, attaining prices above $2,500 will become a big possibility.

However, if the uptrend turns out to be transient, chances abound that ETH could drop significantly. Depending on the nature of the market slump, it could plummet to either $2,240.8 or $2,180.1.