Highlights:

- ETH ETFs end a 9-day outflow trend as August 28 data surfaces with commodities’ net inflows.

- BTC ETFs continue to bleed, with ARKB leading the losses chart for the second consecutive day.

- Bitcoin and Ethereum record price upswings in their 24-hour price changes, signifying possibilities of favorable price movements today.

Ethereum (ETH) Exchange Traded Funds (ETFs) have recorded inflows in its August 28 data to end a 9-day outflow trend. Conversely, Bitcoin (BTC) ETFs bled into the second consecutive day as ARK 21Shares Bitcoin ETF (ARKB) continues to lead the losses pack.

Bitcoin ETFs’ outflow trends seem to worsen with each passing day. Again, it has recorded only losses with no ETF welcoming inflows. On its part, ETH ETFs maintained minimal activities. However, the overall outcome was positive for the world’s most valuable altcoin.

🚨 US #ETF 28 AUG: 🔴$105M to $BTC and 🟢$6M to $ETH

🌟 BTC ETF UPDATE (final): -$105M

• The net flow remains strongly negative for the 2nd day.

• No US Bitcoin ETFs saw an inflow yesterday.

• #Grayscale Mini (BTC) recorded the first outflow ever.

🌟 ETH ETF UPDATE… pic.twitter.com/RuU4JancIG

— Spot On Chain (@spotonchain) August 29, 2024

ETH ETFs End 9-Day Outflow Trend

Among its nine spot ETFs, only three were active on August 28. Like yesterday’s statistical breakdown, two recorded inflows, while only one saw outflows. Grayscale Ethereum ETF (ETHE) maintained its bleeding pattern with about $3.8 million in losses.

For gains, BlackRock Ethereum ETF (ETHA) reawakened after five successive days of registering zero flows. ETHA lead the Ehereum ETFs inflows with approximately $8.4 million in profits. Fidelity Ethereum ETF (FETH) followed closely with $1.3 million. Interestingly, FETH’s latest inflow signifies gains for the second consecutive day.

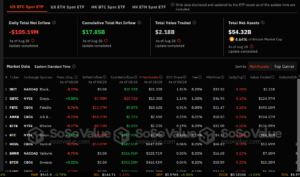

Meanwhile, considering August 28 statistics, Ethereum ETFs’ total daily net inflow reflected $5.84 million. The cumulative total net inflow remained in losses of about $475.48 million. Interestingly, the total traded value read $151.57 million, while the total net assets were $6.97 billion. The total net assets valuation represented 2.28% of Ethereum’s market capitalization.

BTC ETFs Continue to Bleed as Grayscale Mini Records First Outflows

As earlier asserted, Bitcoin ETFs appear to worsen each day. Aside from ARKB leading the losses chart, Grayscale Mini Bitcoin ETF (BTC) recorded its first-ever outflow, summing up a debilitating outlook. ARKB witnessed a whopping $59.3 million in outflows, followed closely by Fidelity Bitcoin ETF (FBTC) with $10.4 million in losses.

VanEck Bitcoin ETF (HODL) and Grayscale Mini occupied the third and fourth spots, respectively. They registered losses of about $10.1 million and $8.8 million. Other Bitcoin ETFs that witnessed outflows were Bitwise Bitcoin ETF (BITB) with $8.7 million, while Grayscale Bitcoin ETF (GBTC) shed $8 million.

The consequence of the overall outflow trends implies that the daily cumulative flow for Bitcoin ETFs was negative at about $105.3 million. Despite the disturbing outflow trend, the total netflow remained significantly profitable at approximately $17.97 billion. The total traded value was $2.18 billion, while total net assets were $54.32 billion.

Bitcoin Might Reclaim $60,000 Soon

While Bitcoin struggles to break above $60,000, chances are high that it could revisit $60,000 today. At the time of press, the flagship cryptocurrency is up by 0.8%, reflecting an approximated $59,600 selling price. Despite its recent struggles, its 14-day-to-date price change variable has remained positive, with a 2.3% upswing. In 24-hour trading volume, BTC saw a 10.6% drop, plummeting its trading volume to about $37.2 billion.

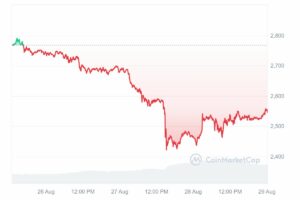

Ethereum Reclaims $2,500

Like Bitcoin, Ethereum’s 24-hour price change also recorded an upswing. However, ETHs saw a more significant surge with 3.6%. It is changing hands at about $2,550, with a market capitalization of about $307.1 billion. The world’s number one altcoin 24-hour trading volume is also down by 9.67%, reflecting $18.3 billion in valuation.