Highlights:

- Metaplanet bought an additional 57.273 BTC, increasing holdings to 360.368 BTC.

- Metaplanet’s stock surged 13% after the Bitcoin purchase.

- The firm’s Bitcoin strategy aims to counter yen depreciation and enhance its financial stability.

In an official announcement on August 20, Japanese investment firm Metaplanet disclosed that it had added 57.273 Bitcoin, valued at 500 million Japanese yen ($3.39 million), to its balance sheet. The firm acquired these at an average price of 8,730,117 ($59,317) per BTC.

.@Metaplanet_JP has purchased an additional ~57.273 #bitcoin for ¥500 million at an average price of ¥8,730,117 per $BTC. As of August 20, Metaplanet holds ~360.368 bitcoin acquired for ¥3.45 billion at an average price of ¥9,573,556 per $BTC. #メタプラネット pic.twitter.com/eIJG33xZBK

— Simon Gerovich (@gerovich) August 20, 2024

According to the statement, this increases its total Bitcoin holdings to 360.368. The acquisition is part of Metaplanet’s plan to boost its BTC reserves with a ¥1 billion loan from MMXX Ventures, following a ¥500 million purchase last week.

The statement read:

“As disclosed in our announcement dated August 8, 2024, regarding the loan and purchase of Bitcoins worth 1 billion yen, we hereby announce that we have purchased additional 500 million yen worth of Bitcoins as below. With this purchase, we have completed the purchase of 1 billion yen worth of Bitcoins.”

Metaplanet Stock Price Jumps 13% After Latest Bitcoin Purchase

Shares surged after the company added BTC to its balance sheet. Metaplanet’s stock price jumped 13% on Tuesday following CEO Simon Gerovich’s announcement of the latest BTC purchase on X. The Tokyo Stock Exchange-listed firm has surged over 645% year to date due to its aggressive BTC buying strategy. Metaplanet’s stock is currently trading at 1,193 yen, up over 10% at the moment, with an intraday high of 1,295 yen. The rally is part of a broader market trend, with the Nikkei 225 index up 1.7% today.

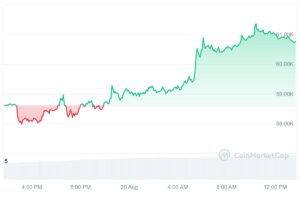

Meanwhile, the BTC price has risen over 3.60% in the past 24 hours, trading at $60,767. The 24-hour low and high are $57,864 and $61,396, respectively. Trading volume also increased by 46% in the last 24 hours, showing strong trader interest.

Metaplanet Boosts Bitcoin Holdings Amid Economic Turbulence

Originally focused on hotel development and operations, Metaplanet has since expanded into consulting on Bitcoin adoption, real estate development, and investments. In May, Metaplanet adopted the largest cryptocurrency as its reserve asset, following MicroStrategy’s approach. The Bitcoin pivot was intended to protect the publicly traded company from the weak Japanese yen.

This year, the Japanese yen began falling sharply against the US dollar because the US Federal Reserve kept interest rates unchanged. In April, the yen fell to its lowest level against the US dollar since the early 1990s, when Japan was recovering from a real estate bubble burst. Today, the yen’s rapid depreciation is due to a challenging macroeconomic environment.

Supporters have promoted Bitcoin as a protection against poor monetary policies. MicroStrategy first invested some of its cash reserves in Bitcoin to guard against inflation and has since become the largest corporate holder of the cryptocurrency.

Metaplanet’s shift to Bitcoin seems to have been successful. At last month’s Bitcoin Conference in Nashville, Gerovich mentioned that the firm was showing signs of being a zombie company before changing its strategy to Bitcoin. The strategy has changed the company’s outlook. Gerovich noted that they eventually saw Bitcoin as the “apex monetary asset” and a “great” addition to Metaplanet’s treasury.