Highlights:

- Ethereum ETFs record $162.7 million net outflows for July 26.

- ETH ETFs’ recent outflows imply that the token has registered three consecutive outflows in four days.

- Bitcoin ETFs record net inflows, completing three consecutive positive netflow days.

A July 26, 2024 update has revealed that investors’ interests appear swayed toward Bitcoin (BTC) Exchange Traded Funds (ETFs) than Ethereum’s. After so much hype, Ethereum ETFs eventually started trading on July 23. Interestingly, it recorded about $1.08 billion in trading volume and $107 million in net inflows on its first day.

Consequently, the crypto community, particularly ETH holders, seemed on the moon as they anticipated more significant volume inflows. However, the past three days witnessed reversals, eliciting concerns among market participants. In addition, there have also been comparisons between BTC’s ETFs and that of Ethereum.

Considering the positive sentiments hovering around ETH ETFs before its launch, the expectation was that it would surpass BTC. However, Bitcoin’s ETFs have remained resilient and taken an early lead over Ethereum’s ETFs with reasonable margins.

🚨 US #ETF 26 JUL: 🟢$52M to $BTC and 🔴$163M to $ETH

🌟 BTC ETF UPDATE (final): +$52M

• The 10 Bitcoin ETFs saw a total inflow of $535M this week, with inflows on 4 out of 5 trading days.

• The above inflow figure does not include #Valkyrie (BRRR) data. This ETF has had $0… pic.twitter.com/ewsIejI4OJ

— Spot On Chain (@spotonchain) July 27, 2024

Ethereum ETFs Suffers Outflows for Three Consecutive Days

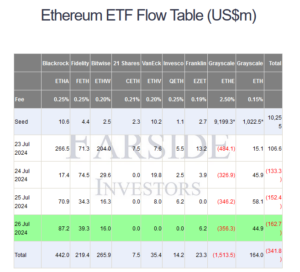

After registering net inflows on its debut day, subsequent days have recorded net outflows for Ethereum ETFs. For context, ETH ETFs registered $133 million in net outflows on the second day. The third day saw a more significant outflow, ranging about $152 million.

In the most recent netflow data, Ethereum ETFs have recorded another negative netflow, completing three consecutive days of registering outflows. According to Farside statistics, the net outflows were about $162.7 million. Out of the nine Ethereum ETFs, The Grayscale Ethereum Trust (ETHE) witnessed $ 356.3 million in net outflows. With its recent outflows, Garyscale’s ETHE has recorded outflows for four consecutive days, contributing significantly to Ethereum ETFs’ unimpressive sales trends.

Conversely, BlackRock’s iShares Ethereum Trust (ETHA), Grayscale’s Ethereum Mini Trust (ETH), Fidelity’s Ethereum Fund (FETH), and Bitwise’s Ethereum ETF (ETHW) have recorded net inflows for three consecutive days. For context, they registered $87.2 million, $44.9 million, $39.3 million, and $16 million, respectively. Despite recording a $6.2 million net inflows, Franklin’s ETF (EZET) recorded zero flows on July 25. Meanwhile, VanEck’s Ethereum ETF (ETHV), Invesco/Galaxy’s Ethereum ETF (QETH), and 21 Shares’ ETF (CETH) all registered zero flows.

Bitcoin ETFs Records Inflows for Three Consecutive Days

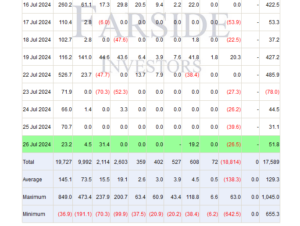

Unlike Ethereum, Bitcoin ETFs have registered positive netflows for three consecutive days. According to Farside data, BTC ETFs recorded a $44.5 million net inflows on July 24. On July 25 and 26, it witnessed net inflows of about $31.1 million and $51.8 million respectively.

Its most recent statistics revealed that Bitwise’s Bitcoin ETF (BITB), BlackRock’s Bitcoin ETF (IBIT), VanEck’s Bitcoin ETF (HODL), and Fidelity’s Bitcoin (FBTC) all witnessed positive netflows. They recorded net inflows of $31.4 million, $23.2 million, $19.2 million, and $4.5 million, respectively.

Meanwhile, Like Ethereum ETFs, Garyscale’s Bitcoin ETF (GBTC) recorded the only net outflows at about $26.5 million. The remaining Bitcoin ETFs recorded zero flows, while Valkyrie’s Bitcoin ETF (BRRR) data was still pending at the time of writing.

How is ETH Reacting to the ETF Sales Relative to BTC?

At the time of writing, Ethereum is changing hands at about $3,270. It reflected a slight 0.4% upswing in the past 24 hours. Per its 7-day-to-date data, ETH is down by 6.4%, with minimum and maximum prices ranging between $3,098.69 – $3,538.38.

On the other hand, Bitcoin is selling for about $67,900, following a 1.2% jump in the last 24 hours. BTC’s 7-day-to-date statistics mirrored a 2.1% spike, with minimum and maximum prices ranging between $64,022.67 – $68,175.02.

Considering the statistics above, it is safe to assert that the ETH ETFs’ flow rate might have influenced Ethereum’s price actions. On the contrary, BTC has shown strength, with positive ETF netflows contributing significantly to its market actions.