Highlights:

- Spot Ethereum ETFs recorded $1.08B in trading volume on their first trading day.

- The new ETFs saw $106.6 million in net inflows, led by BlackRock and Bitwise.

- Despite strong ETF interest, Ethereum’s market price remains stable.

On July 23, nine spot Ethereum (ETH) exchange-traded funds (ETFs) from eight issuers began trading following SEC approval on Tuesday. These ETFs generated over $1.08 billion in cumulative trading volume on their first day on US exchanges. Bloomberg analyst Eric Balchunas highlighted that the combined trading value of the new Ethereum ETFs was 23% of the volume seen by spot Bitcoin ETFs on their first day.

Grayscale’s Ethereum Trust (ETHE) topped the list with $458 million in volume, representing nearly half of the total trading activity. BlackRock’s iShares Ethereum Trust (ETHA) came next with $248.7 million in volume, followed by Fidelity’s offering (FETH) with $137.2 million.

Bitwise’s Ethereum Fund (ETHW) hit $94.3 million in trades, while VanEck’s fund saw around $44.8 million. Grayscale’s mini ETH ETF (ETH) managed $63.8 million in trades. Smaller funds from Franklin Templeton, Invesco, and 21Shares had lower trading volumes, ranging from $8.6 million to $15.9 million.

DAY ONE in the books for Eth ETFs who did $1b in total volume, which is 23% of what the spot bitcoin ETFs on their first Day and $ETHA did 25% of $IBIT's volume. The gap between $ETHE and The Newborn Eight is a healthy +$625m (a sizable chunk of which *should* convert to inflow pic.twitter.com/jaP4dKLrOs

— Eric Balchunas (@EricBalchunas) July 23, 2024

It’s important to note that trading volume doesn’t show net inflows or outflows. The figure indicates the total value of shares exchanged, including both purchases and sales. For example, of the $4.5 billion in trading volume for Bitcoin ETFs on their first day, only about $600 million represented actual inflows.

Previously, Seyffart and analyst Eric Balchunas predicted that the Ethereum ETFs could see around $6 billion in inflows during their first year. This forecast is more optimistic than JPMorgan’s, which predicted that Ethereum ETFs could underperform significantly. According to JPMorgan, the lack of staking rewards might hinder these products’ ability to attract substantial demand. Galaxy Digital CEO Mike Novogratz called Ethereum ETFs “a game-changer” for the entire crypto industry.

Today’s launch of Ethereum ETFs is a game-changer for the crypto industry. It not only opens up access to the second-largest cryptocurrency but also delivers much-needed regulatory clarity, confirming that Ethereum is not a security. @galaxyhq is excited to announce the launch of… https://t.co/Zm5EWt5n5y

— Mike Novogratz (@novogratz) July 23, 2024

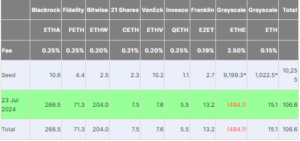

Ethereum ETFs Record $107M Net Inflows on First Day

US-listed Ether ETFs posted a net inflow of $106.6 million on their first day of trading — despite significant outflows from Grayscale’s newly converted Ethereum Trust. BlackRock and Bitwise’s ETFs topped the list, with BlackRock ETHA recording $266.5 million and Bitwise’s ETHW capturing $204 million in net inflows. Fidelity’s FETH came in third with $71.3 million. The inflows to the new spot Ether funds were enough to offset the $484.9 million that left Grayscale’s ETHE on the same day.

Meanwhile, Grayscale’s Ethereum Mini Trust, a new product with lower fees, attracted $15.2 million in inflows. Franklin Templeton’s EZET gained $13.2 million, and 21Shares’ CETH received $7.5 million in inflows.

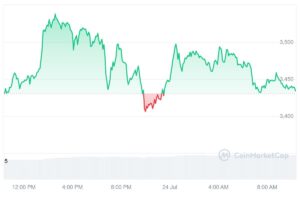

Ethereum Price Remains Stable Despite ETH ETFs Launch

Despite the surge in ETF trading, Ethereum’s price remained relatively stable throughout the day. Currently, Ethereum is trading at $3,433, reflecting only a 0.10% increase over the past 24 hours despite the ETF launch. This suggests that, although there is strong interest in Ethereum investment products, it hasn’t yet had a major effect on the cryptocurrency’s market price.