Highlights:

- BlackRock’s Bitcoin ETF saw $526.7M in inflows on Monday, the highest since March.

- IBIT’s market cap exceeds $22 billion, outperforming the Nasdaq ETF in inflows this year.

- ETF inflows often precede Bitcoin price drops, warns Skew.

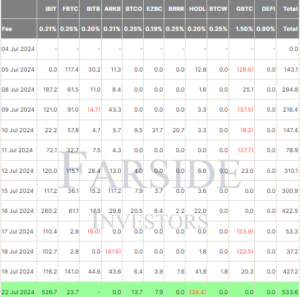

The world’s largest asset manager, BlackRock’s iShares Bitcoin Trust (IBIT), attracted $526.7 million in net inflows on July 22 as investors’ appetite for spot Bitcoin funds continued to grow. This is its largest fund intake since March 13.

The group of ten spot Bitcoin ETFs, except for Bitwise’s BITB, secured its twelfth straight day of gains, amassing nearly $534 million in total inflows. The Fidelity Wise Origin Bitcoin Fund (FBTC) secured second place with $23.7 million in inflows, while the Invesco Galaxy Bitcoin ETF (BTCO) followed with $13.7 million.

The Franklin Bitcoin ETF (EZBC) reported $7.9 million in inflows, while the spot Bitcoin ETFs from Valkyrie, Grayscale, ARK 21Shares, Hashdex, and WisdomTree saw no inflows. In contrast, the VanEck Bitcoin ETF (HODL) was the only fund to report losses, with investors withdrawing nearly $38.4 million on Monday.

Crypto analyst Quinten François notes that IBIT has outpaced the Nasdaq ETF in inflows this year, ranking fourth among more than 3,000 US ETFs.

💥BREAKING💥

BlackRock’s #Bitcoin ETF has surpassed the Nasdaq ETF $QQQ in flows this year

Most successful ETF launch ever! pic.twitter.com/C4zY9Ps5cB

— Quinten | 048.eth (@QuintenFrancois) July 22, 2024

BlackRock’s IBIT Roars

With the latest addition, IBIT’s total inflows over the last 12 trading sessions have reached $2 billion, bringing the total inflows since January to over $19.5 billion. This has led to a strong recovery in the IBIT share price over the past two weeks.

On Monday, BlackRock’s IBIT recorded nearly $1 billion in trading volumes, a milestone it achieved for the third time during the past seven days. The Bitcoin product now holds over 325,000 BTC, valued at over $22.5 billion. In comparison, Fidelity’s FBTC ranks second with assets under management totaling $12.19 billion.

U.S. Bitcoin ETF market caps 👇 $IBIT w/ $22.3 Billion, $FBTC $12.2 Billion, $ARKB $3.4B, $BITB 2.8B pic.twitter.com/wc60z3pmOu

— HODL15Capital 🇺🇸 (@HODL15Capital) July 22, 2024

Amid these impressive inflows and trading volumes, the iShares Bitcoin Trust (NASDAQ: IBIT) share price has surged 15% over the past 30 days. Since its launch in January, the IBIT share price has risen more than 55%.

ETF Flows Insufficient to Sustain BTC Price Upside, Says Skew

In his latest analysis on X on July 23, popular trader Skew cautioned about a “headline curse” as US spot Bitcoin ETFs attracted over $500 million. He said such large inflow days have historically preceded Bitcoin price sell-offs. “As bullish as this is each other time IBIT reported mid-high 9 fig inflow days it occurred around market supply zones,” he added.

In March, BTC/USD reached its all-time high, but the market dropped nearly 25%. Skew emphasized that to trade effectively, it’s crucial to see if the market can maintain demand and momentum for higher prices. He pointed out that sustained demand, effective supply absorption, and overall seller absorption are needed to keep current levels and achieve further gains.

Another large inflow day👇$BTC

As bullish as this is each other time IBIT reported mid – high 9 fig inflow days it occurred around market supply zonessomewhat a headline curse lol

So in terms of actually trading this, the obvious part is now does the market sustain this… https://t.co/qdGwMAvVjl pic.twitter.com/iZ921tpKHW

— Skew Δ (@52kskew) July 23, 2024

At the time of writing, Bitcoin was trading at $67,143, reflecting a 0.25% decrease in the past 24 hours.