Highlights:

- Whales have amassed 8.46 million Chainlink amid the token’s not-too-impressive outlook.

- Only 46% of Chainlink holders are profitable at the coin’s current price.

- Chainlink is dipping below previous support levels, which could become tricky in a bullish scenario.

Whales have continued to demonstrate faith in Chainlink’s expansion prospect, evidenced by consistent token accumulations. In the most recent token procurement sprees, giant investors have amassed 8.46 million Chainlink.

Notably, the Chainlink accumulation has remained persistent despite LINK’s not-too-attractive market actions. Unlike most other cryptocurrencies that have neared their all-time highs (ATHs) with remarkable price spikes, Chainlink keeps displaying unimpressive statistics.

LINK’s Market Readings Disclose Sideways Price Actions

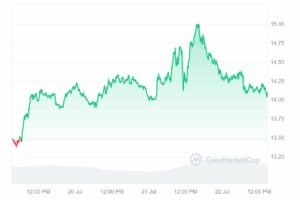

For context, LINK is changing hands at about $14.2, following a 0.3% upswing in the past 24 hours. Chainlink’s current selling price has placed the token at about 73.1% below its $52.70 ATH. In its price change variables across several specified periods other than its year-to-date data, LINK has recorded values lesser than 10%.

In its 7-day-to-date, 14-day-to-date, and month-to-date statistics, LINK registered 0.8%, 9.6%, and 3.6% upswings, respectively. While LINK might have soared by 76.5% in the past year, its short-term market actions have remained relatively stagnant.

Whales Secure 8.46 Million Chainlink

Interestingly, LINK’s price sideways actions have not deterred whale investors from amassing the token. According to a renowned market expert, Ali Martinez, large-scale investors have accumulated 8.46 million Chainlink in the past three weeks.

Whales are on a buying spree for #Chainlink! In the last three weeks, they've accumulated 8.46 million $LINK, valued at approximately $118.44 million. pic.twitter.com/PEtt2Vb39n

— Ali (@ali_charts) July 22, 2024

The market expert stated that the tokens cost an estimated $118.44 million. Hence, when estimated mathematically, it implies that the giant investors accumulated LINK at an average $14 selling price.

IntoTheBlock Summary Supports 8.46 Chainlink Accumulation Claims

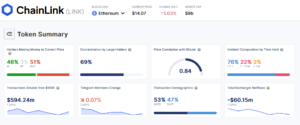

On IntoTheBlock, Chainlink’s statistical summary corroborated the token accumulation claims amid stagnant price actions. The data analytical platform revealed LINK’s “Total Exchange Netflows” variable for the past week to be negative at $60.15 million. When exchange netflows display a negative value, it implies that buying actions are exceeding token sell-offs, indicating a possible bullish breakout.

Moving over to the “Holders Making Money at Current Price” statistics, only 46% are making profits. 51% are amassing losses, while 3% are neither losing nor gaining. Meanwhile, whale investors dominated the LINK holders’ pool with a 69% concentration. Chainlink’s network is busy with transactions above $100K, hitting $594.24 million. “Holders Composition by Time Held” data noted that 76% have owned LINK for over a year. 22% have held the token between a month and a year, while only 2% have owned it for less than a month.

Chainlink Dips Below Three Previous Support

Chainlink price movement mirrored a downtrend, breaking below previous support levels. Currently, it is heading towards another support at $13.431. Considering its sideways market actions, a marked decline could result in dropping below $13.

In a bullish scenario, Chainlink could face challenges, reconverting newly formed resistance levels to support. Therefore, a breakout might appear tricky, compounding an existing price stagnation state. Meanwhile, the $14.958 level remains a crucial resistance, hindering LINK’s short-term surge.

Breaking above $14.958 will result in a more sustainable price surge that could culminate in revisiting LINK’s ATH. In a nutshell, Chainlink’s future appears uncertain based on the points raised in this insight. However, chances abound that the broader crypto market will likely orchestrate considerable LINK price surges.