Popular Decentralized Ethereum-based cryptocurrency Chainlink (LINK) has been recording several losses across most of its market variables, eliciting fear and selling off sprees among its holders, as many seem to have opted for exits rather than accumulating more losses.

Based on the current broader crypto market condition and other events revolving around LINK’s market action, a reversal in the opposite direction might not happen anytime soon, especially as the coin continues to record massive exchange inflows, compounding Chainlink’s debilitating condition.

Alarming Exchange Inflows Continue To Soar

In a recent post that has attracted considerable attention among X users, Ali Martinez, a renowned market expert, has called the attention of his over 64.9K followers to the significant amount of Chainlink tokens shifted to exchanges within a 24-hour interval.

According to the market expert, the last 24 hours saw the transfer of about 18.77 million LINK valued at about $256.20 million to crypto exchanges, which Martinez failed to disclose.

In the last 24 hours, 18.77 million #Chainlink $LINK, valued at approximately $256.20 million, were sent to cryptocurrency exchanges! pic.twitter.com/4MV16ZCZBC

— Ali (@ali_charts) June 22, 2024

While the above revelation by Martinez appears sufficient to induce fear among LINK holders, comprehensive statistics by a notable data analytics platform, IntoTheBlock, disclosed that the inflows seem more pronounced, evidenced by a 7-day inflow and outflow-wide difference.

According to Chainlink’s statistical summary on the data analytical outlet, despite recording $1.2 billion in transactions exceeding $100K, the past week saw the Ethereum-based crypto asset register a net outflow valued at about $35.63 million with a net inflow estimated at around $303.85 million, which is roughly 10X the outflow rate.

Other relevant data revealed that only 37% of LINK holders are making profits at the coin’s present price, 55% are recording losses, and 8% are neither losing nor gaining. Impressively, whale investors are still dominating Chainlink’s holders’ pool at about 70%.

In the coin’s “Holders’ Composition By Time Held” statistics, 75% have held on to the token for more than a year, 23% have owned LINK for more than a month but less than a year, while 2% have held on for less than a month.

Implications Of Chainlink’s Soaring Exchange Inflows

In the crypto space, scenarios like the one Chainlink seems to replicate have on many occasions, culminated in driving massive price declines for the tokens involved because it invariably indicates a lack of trust in the coin’s expansion prospect.

Consequently, chances are high that Chainlink might decline further, with the potential to break below $10 despite showing a glimpse of attaining $20 in the previous month, evidenced by consistently impressive market actions.

How Has Chainlink Price Reacted – Is A Break Below $10 Imminent?

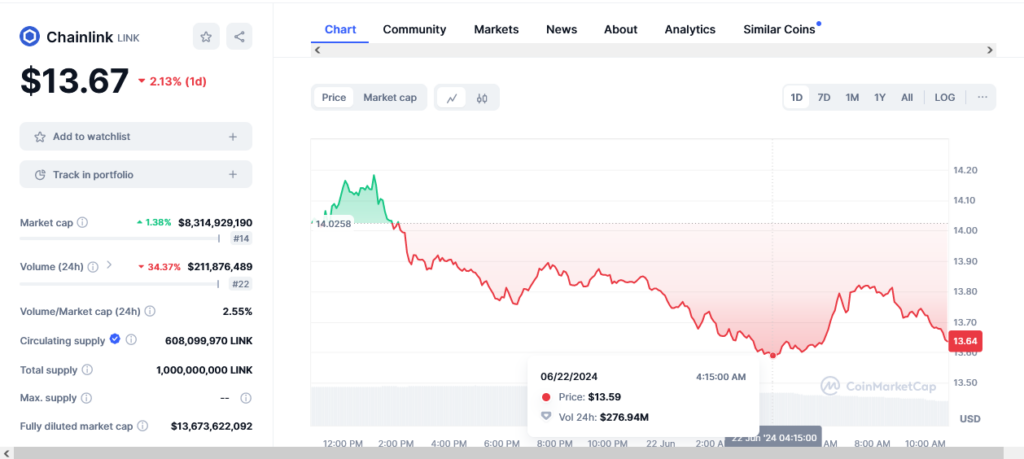

At the time of press, Chainlink’s market statistics on the popular crypto assets tracker site, CoinMarketCap, revealed that the digital asset is changing hands at about $13.67, reflecting a 2.13% decline in the past 24 hours, with a least $13.59 price level and a peak 13.89 selling price.

The past week saw LINK register minimum and maximum prices between $13.21 and $15.18, respectively. The coin’s market cap recorded a slight upswing of about 1.38% in the last 24 hours to worth $8.3 billion. On the other hand, Chainlink’s trading volume recorded a significant 34.37% decline with a $211.8 million valuation.

The statistics above already summarize a challenging future outlook for LINK, which could deteriorate further once the impact of its skyrocketing exchange inflows becomes more pronounced. Hence, it is safe to say that the coin is not far from breaking below $10.

Read More

- CoinStats Suspends User Activity After Security Breach Affecting 1,590 Wallets

- 20 Top Cryptocurrencies to Watch for 2024 – Detailed Reviews

- DePIN Crypto Projects to Watch In 2024 – Top 10 DePIN Coins to Buy

- Next Cryptocurrency to Explode in 2024

Disclaimer: Cryptocurrency is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.